250% Upside in a Market Oligopoly Nobody’s Watching

Sticky recurring B2B revenue in a non cyclical industry growing 25%+ annually

Price: 11.68

Sh/O: 34.05M

Mkt Cap: $397M

LT Debt: $147.2M

Leases: $121.8M

Cash: $9.8M

EV: $657M

Summary Thesis

Barnes & Noble Education, Inc. (“BNED”) is one of the largest contract operators of physical and virtual bookstores for college and university campuses and K-12 institutions across the United States. BNED is also one of the largest textbook wholesalers and inventory management hardware and software providers. BNED operates 1,245 physical, virtual, and custom bookstores and serve more than 5.8 million students.

A major driver of recent top and bottom line growth is the First Day® program, which provides students with course materials as part of tuition or fees at a deeply discounted rate. This program saw revenues increase over 20% year-over-year in early 2025 and has been widely adopted, with nearly 1 million students enrolled for the spring 2025 term.

The company has also reported a surge in new campus store partnerships, adding over 20 new institutions ahead of the 2025–2026 academic year, more than double the number from prior years.

BNED is focused on improving profitability through operational efficiency and store portfolio optimization, including closing under performing locations and expanding its FDC program into 80% of the market yet to be served by this model. The company trades at 3.8X FY27 EV/EBITDA with strong growth and operational leverage visible over the coming years.

Business overview

The company generates revenue via 2 main avenues:

First is by providing books (mostly digital) via the First Day program. This business has been guided to a mid-teens EBITDA by management and the cash flows from it are visible and substantial in 2024 financials.

Furthermore although this business model is relatively new for the company, it has all the makings of an extremely valuable oligopoly business with sticky recurring revenues at attractive margins.

Furthermore BNED is uniquely positioned to grow this offering through it’s existing partnerships with universities and via new schools over the coming years. The company has ~1M students on the platform with a total market size of ~20M students.

Second, the bulk of the revenue is generated via the company’s bookstores and wholesale segment, this revenue is low margin (0.5-2% EBITDA). The company has been rationalizing this segment to increase profitability going forward. I expect some improvement here as store closures start to increase margins, but the this business does not move the needle for BNED’s valuation.

I’ll focus on the FDC business as a result.

The Game Changing FDC Business Model

The FDC business provides a win-win model for all parties involved. With the emergence of AI and digital books, book sales have plummeted due to students either not buying books or pirating them.

(About 50% of students who use digital textbooks admit to having obtained at least some pirated copies. This pattern has remained stable for several years, despite awareness campaigns and legal actions).

As a result publishers are incentivized to provide discounts to entice students to buy. Students are more willing to buy at lower prices. Furthermore students do better in school when they have the most up to date copy of the textbook at the start of the term complete w/ interactive components only available via publisher portals.

BNED has used this dynamic to push universities to accept a per credit fee for providing all the students reading material for their courses up front at a substantial discount (40%+).

Doing so increases utilization and provides students with books at $300/Yr. As a result publishers continue to receive value for their books with much better throughput as BNED’s FDC program is opt-out once a university has implemented it. As a result 85%+ of students use the program once implemented. This cost is minuscule compared to most tuition fees.

At the same time authors and colleges are happier as all students are provided their material before the start of class and incentives for authors to continue to update textbooks are preserved.

Moaty Characteristics of the Business

Oligopoly Industry Structure:

BNED operates in an industry with only one other scaled player, Folett (private). Schools have little pricing power and BNED/Folett have strong leverage over publishers given their distribution access.

Long-Term Contracts:

BNED typically operates its campus stores under long-term agreements with universities and K-12 institutions.

These contracts provide a degree of revenue stability and create a barrier to entry for competitors.

Switching Costs:

The bookstore is often deeply integrated into the universities ecosystem via software and financial aid platforms. Once FDC is implemented switching costs for universities are substantial.

Brand, Scale and publisher relationships:

BNED’s brand and scale has allowed it to forge strong relationships with publishers and universities. They are in a unique position to be able to provide universities with deeply discounted course material not easily replicated by new entrants.

Given this backdrop, Management has guided to a mid-teens EBITDA margin for the FDC Business, with room for expansion as the product scales. They’ve achieved about 13.5% margins here already based on my estimates.

Competitive Position

BNED is second to Folett, the only other major player in the space.

What are the Unit Economics and TAM Opportunities?

Reachable population: ~15.3 M under-grads plus 3 M graduate/professional students (NCES & NSC).

If 60 % of students adopt an access model at $300 / yr:

Serviceable revenue pool: ≈ $3.3 B.

At a 15 % steady-state EBITDA margin: ≈ $500 M sector EBITDA.

BNED’s share if it keeps its current 25 % student share: ≈ $125 M EBITDA — >3× today’s total company EBITDA, with limited cap-ex.

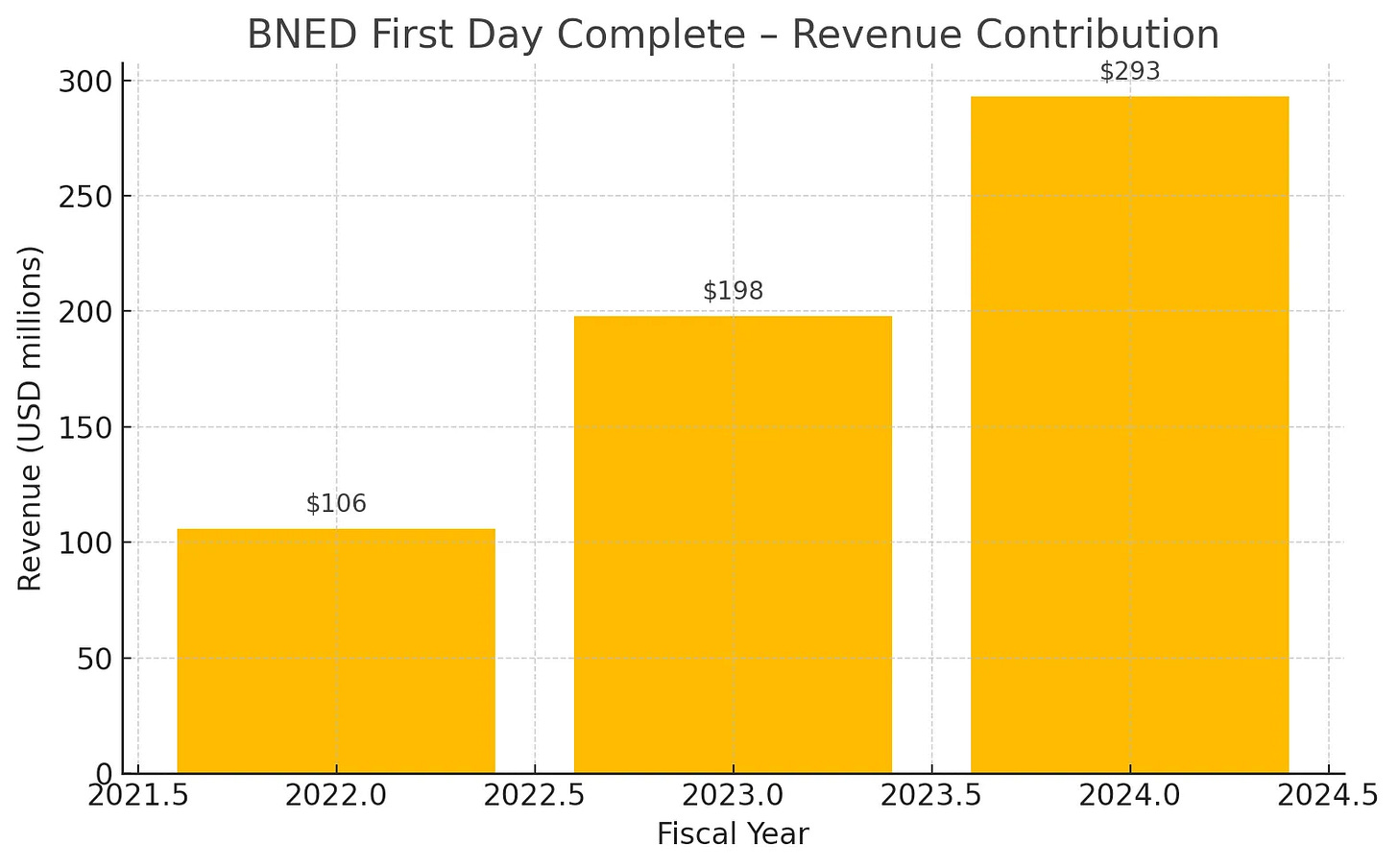

How has BNED’s FDC growth looked thus far?

Campus reach: Fall-term adoption has compounded at ~28 % annually (112 → 183 stores in two years).

Revenue momentum: First Day Complete has grown ~80 % CAGR since FY 2022, already approaching a $300 m run-rate and driving the bulk of BNED’s top-line growth.

Operating leverage ahead: Management is pushing for broader mandatory adoption (fewer opt-outs) and higher attach rates, suggesting further step-ups in per-store revenue as the program matures.

Industry Overview

The industry operates in an Oligopoly structure with 80% of the market still up for grabs with the FDC business model. While Follett is in the lead with more than double the students, BNED is growing faster and been able to win more Follett accounts than Follett has BNED accounts (see below).

Given the formidable barriers to entry in this market I doubt we’ll see new entrants. It’s easy to imagine a future where much of the US student population is using these services, rolled into their tuition fees. In such a world with an oligopoly structure, I would expect BNED and Follett to be able to raise prices above inflation while keeping input costs at bay from publishers given their positioning in the market.

Who is the stronger competitor?

Because neither company discloses every contract change—and many community-college wins fly under the media radar—the actual numbers are likely higher. Still, press releases suggest that BNED’s First Day Complete has been net-gaining clients from Follett by roughly 2:1 since 2023.

Tally (publicly announced):

BNED has taken ≈ 4 campuses from Follett.

Follett has taken ≈ 2 campuses from BNED.

How’s all this convert to cash?

FY25 Adj EBITDA: 71M

Fy25 EV/EBITDA: 9.2x

Fy28 EV/EBITDA: 3.8x

Looking at the quick valuation above, it’s clear most of the growth in the companies cash flows (unlevered) is coming from the First Day Complete model. There is some value in the legacy segment which has been depressed and is set to rebound given operational efficiencies (store closures).

Using growth in absolute students similar to the recent past we can see a path to $169M in EBITDA in 3 years, most of which will flow to the bottom line due to minimal capex spend.

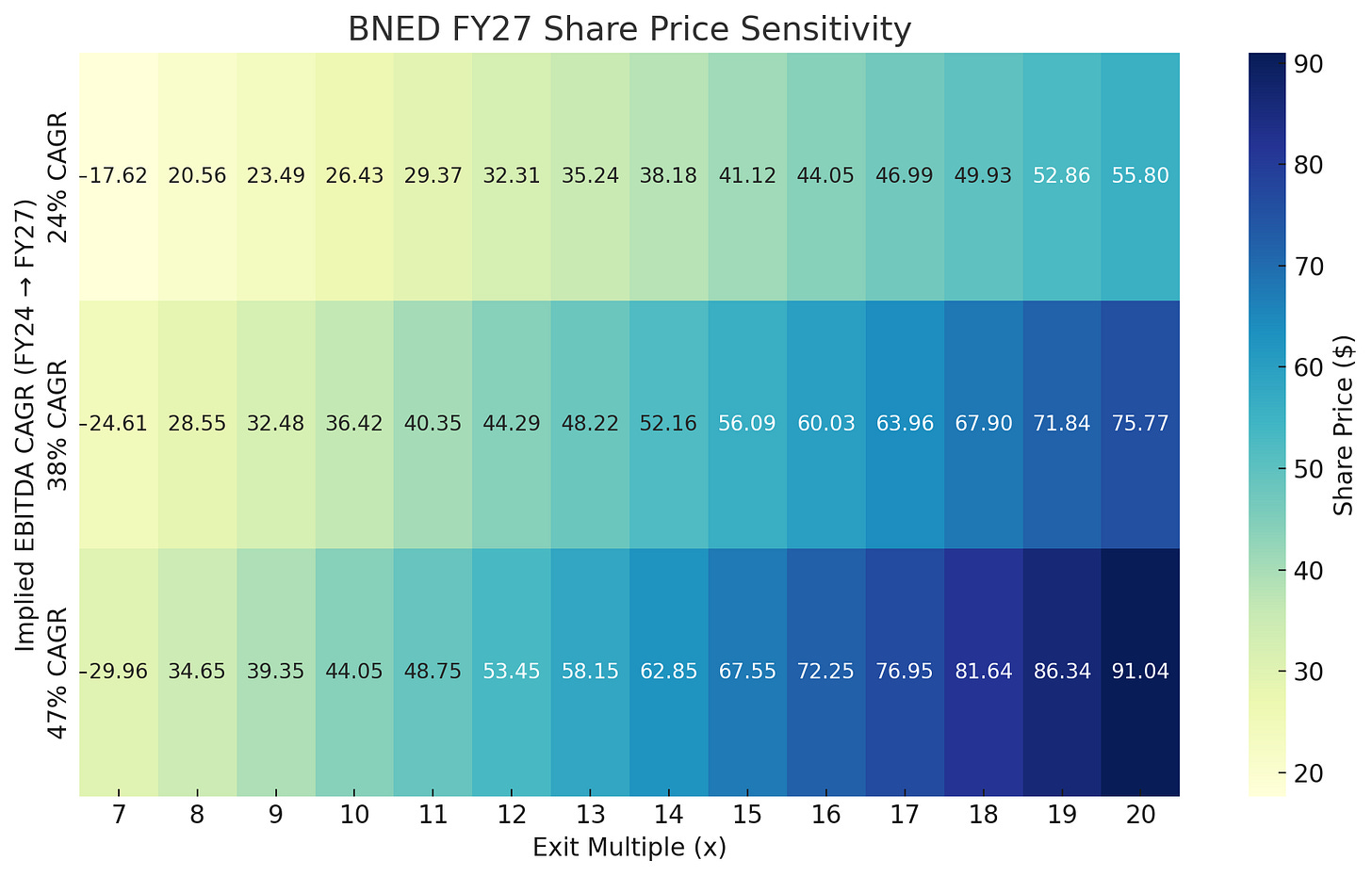

There are no real peers in this industry, but what would you pay for a recurring oligopoly b2b business with sticky revenues in a non-cyclical industry? I think 3.8x is too cheap. 15x to 20X would be fair if they continue to execute at current levels.

The exciting part about this opportunity is that, even without multiple expansion the stock has 150% growth ahead of it at current multiples and execution cadence.

Price Target

At 12X Fy27 EV/EBITDA we get to about $44/Share in value or about 250% increase. Feel free to choose your fair value multiple and assign value accordingly:

And there is good reason to believe in continuing execution; BNED’s most recent press release suggests FDC is ramping up not just continuing at it’s already strong pace.

Barnes & Noble Education Announces Surge in New Campus Store Partnerships

May 12, 2025

Over 20 new institutions across a mix of two- and four-year public and private colleges and universities turn to Barnes & Noble College for innovative, customer-focused solutions

(NYSE: BNED), a leading solutions provider for the education industry, today announced a wave of new campus store partnerships with colleges and universities across the country. These institutions, representing a diverse mix of two- and four-year public and private schools, have selected Barnes & Noble College (BNC) to operate their campus stores ahead of the 2025–2026 academic year, with over 20 campus stores scheduled to open from February through August this year. This total is more than double the number added during the same period in each of the prior two years.

This momentum highlights the growing demand for BNC’s innovative, customer-focused approach as colleges and universities seek trusted partners that can support improved access, affordability, and the omnichannel retail experience.

…. All choosing BNC for its proven ability to deliver innovation and operational excellence. Notable new partners include Villanova University, Georgia Southern University, Oral Roberts University, the Colorado Community College System, UNC Pembroke, Xavier University, the University of Denver, and more.

More than half of the new institutions will launch First Day® Complete, BNC’s rapidly growing, industry-leading affordable access program, beginning Fall Term 2025.

Total of 7 named colleges: 188K students (compared to 930K currently in FDC)

Though it is unclear how many will be inducted into the program, the recent announcement is indicative of continued momentum in the FDC program as more than half are expected to launch FDC in August.

Why does this opportunity exist?

The opportunity is underfollowed given the difficult to interpret capital stack and recent history of the company that wiped out much its value. There is also only one analyst covering the stock. Furthermore managmeent holds no earnings calls and is not easy to get a hold of.

Limited Analyst Coverage

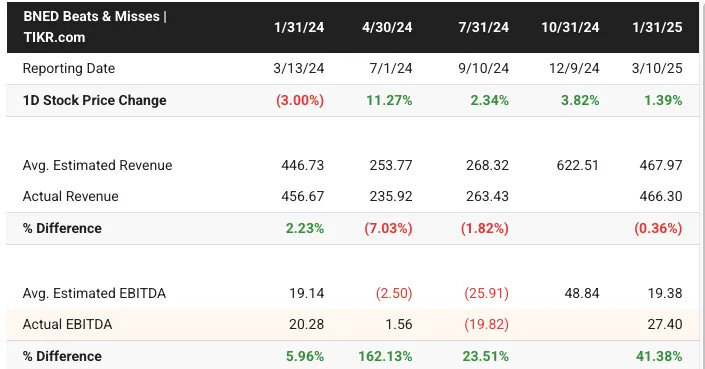

Only one Needham analyst covers BNED with 2025 EBITDA target of 59.5M vs. my projection closer to $71. The analyst’s lower estimate stems from an expectation of anemic growth YoY.

The company has largely beat expectation in 4 of the last 5 quarters, with major beats in actual EBITDA, while total revenue has decreased as unprofitable stores continue to be shuttered.

Catalysts

the ATM filings seem to have been completed, which have kept the stock down in the recent past

BNED was recently inducted into the Russell Index

More analyst coverage

Inflecting FDC campuses and revenue as indicated via press release

Folett merger or sale by PE company owner

Clearer disclosures that split out FDC more clearly from legacy business

Top- Line revenue growth

Risks

Business model

BNED is in a very different position post COVID. They have shed their unprofitable campus stores and are profitable again in their legacy business. The FDC business continues to grow at 20%+ CAGR with expanding margins and is a much more reliable source of cash flow.

Recent equity financing has allowed the company to reduce leverage w/ a goal to reach sub $10M in annual interest expense in the medium term. Currently at 2X Debt/EBITDA w/ visibility into strong EBITDA growth. Liquidity is not an issue.

The $100M Shelf

The company filed a $100M shelf in January. They have yet to tap this and have repeatedly stated this is a “financial flexibility tool, not an imminent raise” and that they’ve now “right-sized the balance sheet.”

This posture is backed up by IMMR, the largest shareholder which is well aligned w/ minority shareholders here.

concern ive heard raised (from somebody that owns it):

1) publishers are concentrated and are the content owners, so will extract more economics when BNED margins hit a certain level

2) the stroke of the pen / regulatory risk related to opt in vs opt out, which has a big impact on uptake and the subscription economics

i dont know the name well enough to opine, but thought id share what id heard

Have you looked at IMMR? Owns 11.3mm shares worth close to half its market cap ($7.8 share). Cash worth $6/share + small equity positions, profitable patent biz. Run by 2 HF mgrs.